Tax Planning

The coolest thing about tax planning is you can literally add thousands of dollars to your bank account without pulling out your hair because of that crazy client or those painful negotiations with the agent from hell.

It's like getting a couple of extra commission checks without doing any of the work!

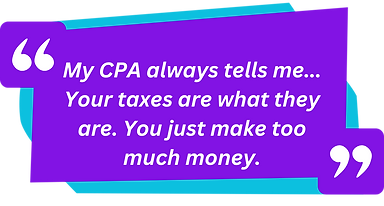

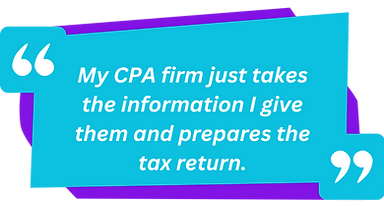

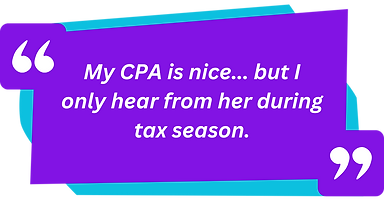

Do any of these situations sound familiar to your relationship with your own CPA?

.png)

.png)

.png)

.png)

The PROBLEM

You are working with a

TAX PREPARER

The SOLUTION

You need to work with a

TAX STRATEGIST

Did you know???

MOST PEOPLE WILL SPEND MORE MONEY ON TAXES THAN ANYTHING ELSE IN THEIR LIFETIME!!!

Most real estate agents think having a CPA prepare their tax returns results in them paying as little in taxes as possible.

A CPA or licensed tax professional will ensure your returns are filed accurately and on time. That may provide you with some peace of mind, but it doesn’t help you reduce your tax liability.

The truth is, there is very little a CPA can do to reduce your taxes if you only meet with them during tax season.

Tax preparation is reactive. It reports the history of your income and related expenses over the past year.

On the contrary, tax planning is proactive and forward looking. It delves into both short-term and long-term goals and develops tax saving strategies based on those goals.

Tax planning isn’t just about minimizing your taxes. It also involves strategies that build your wealth over time and help you reach your dreams.

Our team of tax strategists will work with you throughout the year to walk you through the strategies that are most impactful for you based on your unique goals and how much you can save in taxes.

But here’s the thing, you cannot be passive when it comes to tax planning. You must be willing to be proactive and involved with your financial team if you truly want to reduce your taxes.

This is hands down the number one issue we see with real estate agents and other small business owners. They simply hire a CPA and then assume they are saving as much as they can on taxes.

The agent is too busy to focus on taxes and the CPA is so busy preparing returns it leaves them with no time to actually implement tax saving strategies.

“Tell me and I forget, teach me and I may remember, involve me and I learn.” – Benjamin Franklin

Our tax planning engagements are meant to provide you with the knowledge, strategies, and tools to drastically lower your taxes and create generational wealth.

But you must be involved… we cannot simply wave a magic wand and make your taxes disappear.

Armed with the knowledge and tools of our tax strategists, you will gain a clear understanding of what you need to do to reduce your taxes and grow your wealth.

Are you ready to add thousands back to your bank account without the hassle of another closing?

Click the link below to schedule a FREE Consultation with one of our tax saving strategists.